Showing: 32 items

Refine By

April 01, 2024 | by Diebold Nixdorf

Explore case studies and learn how your peers leverage Diebold Nixdorf banking products and services for their success.

December 13, 2021 | by Jodi Neiding

Although digital and automated transactions are growing, it doesn’t mean that banks can’t provide unique experiences at these channels while maximizing opportunities to generate leads, cross-sell and reinforce cross-channel richness.

November 12, 2021 | by Habib Hanna

Despite the growing use of digital payments, cash will remain an important payment method; we’re seeing an increase in cash deposits, laying the foundation for a business case for cash recycling.

October 26, 2021 | by Anja Popp

Dive into the latest research on the types of consumers using your banking channels. We partnered with NielsenIQ to survey 12,000 people across 11 countries. Find out what they really want in a bank.

July 12, 2021 | by Scott Weston

How are you optimizing your ATM network from a placement perspective? The best locations are situated where your consumers are going on a daily basis for their everyday shopping needs. Continue reading for some tips to ensure you get the most out of your network.

June 14, 2021 | by Scott Weston

When building the foundation for a successful ATM strategy there are three key pieces of information you need to consider: Consumer Analysis, Market Analysis, and ATM Network Analysis. Each are equally important, yet very different. Careful analysis of these components will reveal areas of strength and areas for improvement in your ATM network.

June 02, 2021 | by Diebold Nixdorf

Learn about how Sparkasse Hannover, improved customer experience and an overall availability while reducing cost by 30% to 40%.

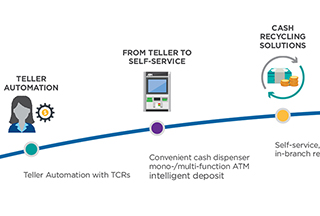

May 03, 2021 | by Ludwig Simoen

In a cash recycling scenario, your own consumers are replenishing your ATMs for free. Are you taking advantage of it?

April 27, 2021 | by Scott Weston

One of the very first questions we always ask banks and credit unions is this: What is the role of the ATM within your network? In pop culture terminology, you might call it “defining the relationship” (DTR)... and it’s not always as easy to answer as you might think.

April 19, 2021 | by Diebold Nixdorf

See how to make your self-service network more sustainable, efficient and future-proof for a changing world.

September 28, 2020 | by Scott Weston

Merely having a deposit-accepting ATM is no longer the most efficient, convenient or fulfilling option for transaction migration. It simply isn’t a good experience for consumers or branch employees, and the cost to FIs for balancing is cumbersome. Deposit Automation technology creates the best overall experience and efficiency for migrating transactions out of the branch… especially with the acceleration of our dependence on self-service through COVID.